UK

They have been described as sitting ducks: UK-listed companies that really ought to be more highly valued and are therefore ripe for being picked off by cash-rich foreign predators.

It’s bad news for the London market but for private investors, picking the right takeover target can mean a quick profit, as bidders normally have to pay well above the current share price to win control.

And the bids have started coming thick and fast with every few days seeming to bring a new swoop for an unloved stalwart of the London stock market. We reveal ten UK companies that are considered potential targets.

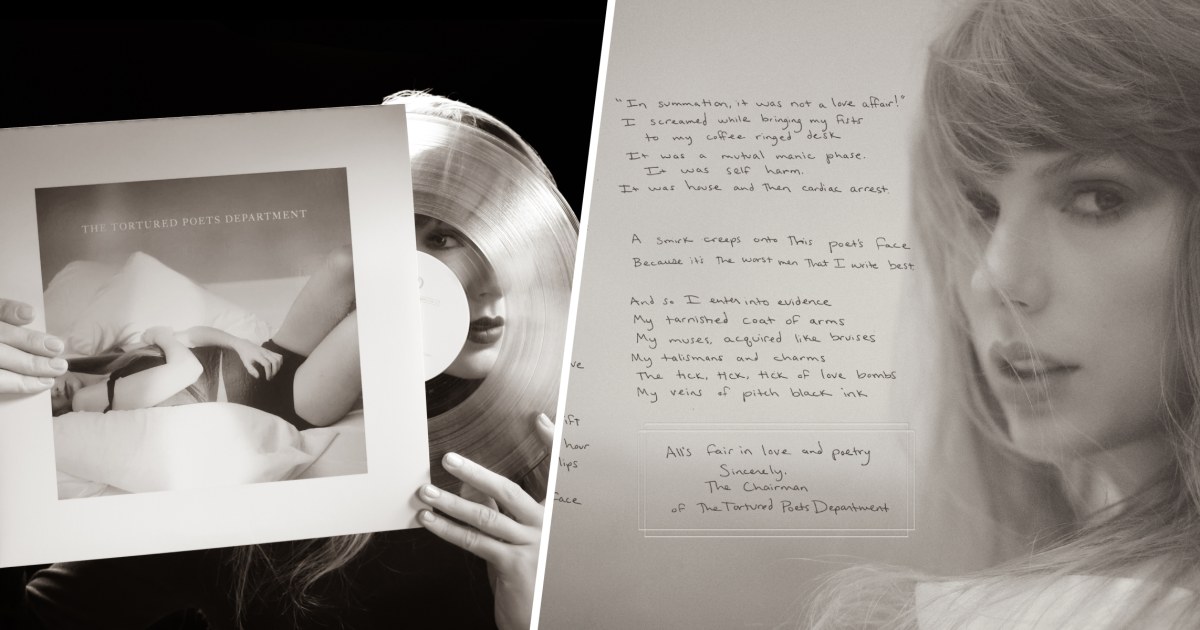

On the up: The FTSE 100 has made strong gains over the past six months and hit a series of record highs recently

Charles Hall, head of research at investment bank Peel Hunt, has described the ‘relentless’ merger and acquisition (M&A) activity as a ‘feeding frenzy’.

It has led to much soul-searching in the City about why Britain cannot keep hold of the companies that make the country tick.

And industry sources suggest the deal-making seen so far this year is just the tip of the iceberg – with far more to come.

It is bad news for the Square Mile – but for investors there can be a big reward.

The price paid last year by bidders was 51 per cent higher than the shares were trading before the deal was announced, according to analysis by broker AJ Bell.

That might seem like rich pickings for anyone who can spot a sitting duck – and turn it into a golden goose.

But watch out, says AJ Bell’s investment director Russ Mould.

‘Buying a stock purely in the hope of a bid is not a good idea,’ he said.

‘A better plan is to focus on the key fundamentals that make any stock potentially attractive.’ That way, he says, if no takeover bid transpires, you still have the potential for capital growth, income from dividends, or both.

‘Any bid that comes along then is a bonus and if one does not appear the investor still owns stock which meets their investment criteria and fits with their long-term plans, rather than some wild punt.’

Richard Hunter, head of markets at Interactive Investor, said even as it hits new record highs, the FTSE 100 is ‘famously undervalued in comparison to most other developed global markets’.

He added: ‘Given these valuation levels, it would not be surprising to discover that many other overseas corporates are currently running the slide rule over potential UK targets.’

And the prospect of interest rate cuts could also boost appetite for takeover bids by private equity barons, who finance their deals with debt.

‘Given that there is now an end in sight to higher borrowing costs, with rate cuts expected by late summer, more private equity suitors may be circling,’ said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

The latest takeover frenzy accelerates a trend that started last year – when there were 64 deals, according to Jason Hollands, managing director or online broker Bestinvest.

He added that buyers are ‘taking advantage of dirt-cheap valuations’. Here are ten companies that City experts believe may become takeover targets – presenting a potential opportunity for investors.

Unilever, home to brands such as Marmite, has seen share prices fall 21 per cent from their peak

Unilever: Value £105bn

Share price down 21pc since peak in September 2019

A bid for the consumer goods giant, where shares are down 21 per cent since their peak, would be a seismic event on the stock market.

Fund manager Nick Train, one of Britain’s leading stock pickers, has said it will take the shock of a mega-deal like that to make investors realise just how undervalued the whole of the FTSE 100 really is.

‘Sometimes you need a cathartic event to turn the tide,’ he said.

Home to some of Britain’s best-known brands, from Marmite and Hellmann’s to Dove and Domestos, it would take a buyer with very deep pockets to pull this one off.

But Unilever is cheap in comparison to many of its global competitors.

And it is this ‘poor share price performance’ alongside its ‘good brands’ that make it a potential takeover target, according to Mould at AJ Bell.

Shares in Asos are down 95 per cent since their peak before the Covid lockdowns

Asos: Value £430m

Share price down 95pc since peak in March 2018

As one of the best-known names in fast fashion, it may come as a surprise that Asos has been dubbed a potential takeover target.

Popular among Gen Z and millennials, its shares boomed after lockdown as it cashed in on shoppers swapping jogging bottoms for going-out clothes.

But as high interest rates and inflationary pressure bite, the company has again fallen on tough times.

Shares are down 95 per cent since their peak.

This, according to Garry White, chief investment commentator at Charles Stanley, makes it ‘vulnerable to a bid’.

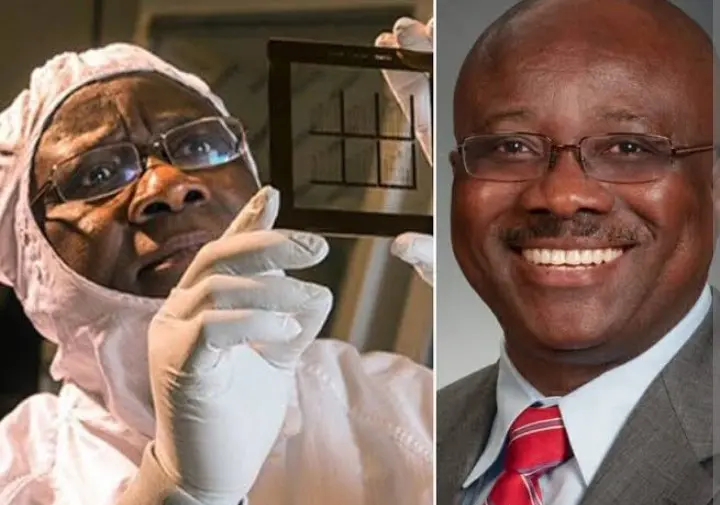

Burberry is among the most likely of UK firms to be targeted in a takeover, say analysts

Burberry: Value £4.3bn

Share price down 55pc since peak in April 2023

From high street to high end fashion, Burberry is also seen as fair game for bargain hunters.

Shares have slumped more than 50 per cent in the past year as the famous trench coat maker falls out of fashion in the City.

Weak demand for luxury goods in China is taking its toll.

A survey of City analysts by Bloomberg found Burberry among the most likely takeover targets.

Abrdn investment manager Sasha Kachanova said Burberry ‘remains a potential takeover target particularly at its current valuation’.

Richard Hunter at Interactive Investor said: ‘Sales growth is becoming increasingly hard to find in a high-end luxury sector.’ He added that investors prefer companies such as LVMH and Hermes. ‘Burberry’s recent profit warnings have done little to lift the mood,’ he said,

He added that the steep decline in the share price put it ‘in the frame for potential suitors’.

Insurance giant Prudential turned its focus to Asian markets… and is now feeling the heat from an uncertain Chinese economy

Prudential: Value: £21bn

Share price down 53pc since peak in January 2018

It is not just Burberry that is feeling the heat from an uncertain Chinese economy.

FTSE 100 insurance giant Prudential, which was founded in the UK in 1848, left the UK insurance market in 2019 to focus on fast-growing Asian markets.

But the group was whacked by zero-Covid policies in its core Hong Kong market.

Like Burberry, Hunter said its exposure to China and dwindling share price may make it prime for a takeover. Shares are down more than 50 per cent from their peak.

Hunter noted that the country’s high youth unemployment rate, low consumer confidence and beleaguered property sector have left investors spooked.

A disappointing first-quarter update did little to lift the mood.

Homewares chain Dunelm has seen sales fall by more than a third since the end of 2020

Dunelm: Value £2bn

Share price down 30pc since peak in October 2020

Dunelm is also on the potential hit list as predators circle the London market looking for bargains.

The company started life in 1979 as a curtain-selling market stall in Leicester, run by Bill and Jean Adderley.

Known for years as a textiles specialist, it has branched out to sell other goods, such as lamps and furniture. It is now one of the biggest homeware retailers in the UK and listed on the FTSE 250.

However, boss Nick Wilkinson has warned that consumer spending ‘remains under pressure’ with demand for DIY and big-ticket items lagging.

The company enjoyed a temporary boom when stores reopened after lockdown. But shares have slumped by more than a third since the end of 2020.

Susannah Streeter at Hargreaves Lansdown said this makes Dunelm a goal for companies looking for a cheap win.

‘Dunelm could be of interest for firms wanting to expand e-commerce interests,’ she said. ‘Its broad range of homewares makes it a nimble operator in the home furnishings space.’

Entain, owner of Ladbrokes and Coral, has a relatively low stock-market value

Entain: Value £5bn

Share price down 66pc since peak in September 2021

With a value of just £5billion, Ladbrokes and Coral owner Entain is worth just a third of what it was less than three years ago.

This has seen the blue-chip gambling giant marked out as a possible takeover target.

Shares have been under pressure for a while as the UK pushes ahead with tighter regulation, including limits on the amount of money punters can bet.

This will see profits slump for Entain which – unlike listed rival Flutter, the owner of Paddy Power – makes most of its money in Britain.

The group has also been plagued by boardroom uncertainty after its chief executive Jette Nygaard-Andersen made a shock exit last year.

Recent reports suggest private equity titans Apollo and CVC Capital are mulling bids for parts of the group. And US rivals MGM Resorts and DraftKings have both had takeover offers knocked back.

Russ Mould at AJ Bell said the company remains in the frame.

‘Entain was already the subject of two failed bids in 2020 and 2021 and the share price has plunged,’ he said.

Shares in Dr Martens plunged to a record low last month after a series of profit warnings

Dr Martens: Value £778m

Share price down 84pc since peak in February 2021

Another stock that shareholders may want to get their hands on is Dr Martens.

Last month shares plunged to a record low after it issued its fifth profit warning in three years. Shares are down 84 per cent since their peak.

It came as demand in the US continues to stall and costs jump for the bootmaker.

Its air-cushioned soles were originally developed by Munich-based Dr Maertens and Dr Funck. The UK patent rights were sold to R Griggs Group in the 1960s – and the Dr Martens brand was formed.

The clunky boots became synonymous with the punk era in the 1970s and they got a new lease of life two decades later with Britpop.

Because of this long-standing legacy, Charles Stanley’s White said this could make it ripe for a takeover.

Noting its recent all-time low, White added: ‘A large US brand with a good distribution and marketing network may find the iconic bootmaker a good fit.’

An anonymous hedge fund investor told the Mail on Sunday last month that they had met with management and ‘there’s something in the offing’.

Potential buyers could include Louis Vuitton-owner LVMH as well as VF Corporation in the US, the company behind Timberland, Vans and the North Face.

Analysts say shares in Revolution Beauty, down 84 per cent from their peak, are ‘very cheap’

Revolution Beauty: Value £83m

Share price down 84pc since peak in August 2021

Revolution Beauty, whose shares are down 84 per cent from their peak, has been branded ‘very cheap’ by analysts.

The low-cost make-up firm has been in the doghouse after auditors at accountancy firm BDO refused to sign off on its financial accounts for the year to February 2022.

This led to shares in the firm to be suspended on the London Stock Exchange for nine months.

Despite the turmoil, Wayne Brown, head of consumer research at broker Liberum, said the company was on more ‘solid footing’.

Because of this, he said the firm looks ‘very cheap’, and while cautioning that it may not be takeover target in the immediate future, speculation is mounting that it could be in play in future.

Standard Chartered bank’s share price is down 59 per cent from its peak

Standard Chartered: Value £19.5bn

Share price down 59pc since peak in November 2010

With Standard Chartered’s boss recently admitting that the bank’s share price performance – down more than 50 per cent from its peak – has been ‘c**p’, it is perhaps not surprising the company has been identified as a target.

The lender, which operates in markets such as China, Hong Kong and Singapore, is best known in Britain as the shirt sponsor of Liverpool FC.

Boss Bill Winters’ blunt assessment of the share price reflects both issues that are specific to Standard Chartered and wider concerns about UK stock market valuations.

And analysts at AJ Bell believe it could be a target because of this knock-down price.

In January last year, it was reported that First Abu Dhabi Bank had hired advisers to work on a takeover, then walked away from the deal.

But reports suggest other suitors from the Middle East, possibly Abu Dhabi or Saudi Arabia, are now eyeing a move.

Marston’s was hit by Covid lockdowns and has struggled to recover since

Marston’s: Value £175m

Share price down 92pc since peak in February 2007

Interest may also be brewing in pub and hotel group Marston’s, where shares have almost halved from their peak.

Rival Wetherspoons is booming as punters flock in for cheap pints, but rivals such as Marston’s are having a much harder time.

Having suffered badly during Covid, shares are still languishing well below pre-pandemic levels and are down another 17 per cent so far this year.

Victoria Scholar, head of investment at Interactive Investor, cited Marston’s as a potential target.

In 2021, the group snubbed a £666million approach from private equity. At the time it said it significantly undervalued the British pub operator.

Marston’s – the brewer of Pedigree, Hobgoblin and Lancaster Bomber beer – said this was the firm’s third takeover proposal.

Marston’s first started out as a family business over 180 years ago and today has 1,400 pubs and around 11,000 employees across the UK.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.